Budgeting is the act of planning your expenses through a specified period of time. When the topic of budgeting arises, a vast majority of people limit their imagination to a series of spreadsheets and budgeting software.

However, budgeting is so much more that. Budgeting can be compared to likes of a roadmap which can make your life easier by taking care of your unhealthy expenditures.

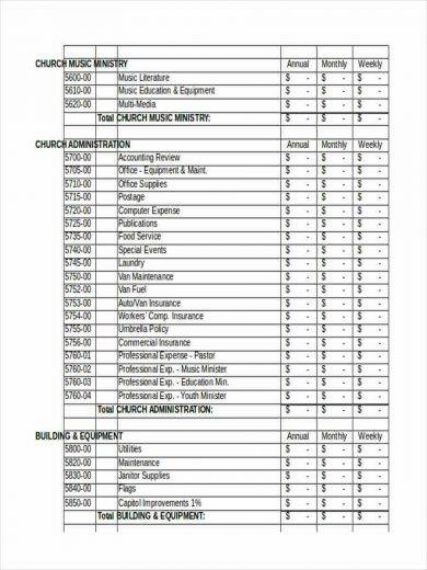

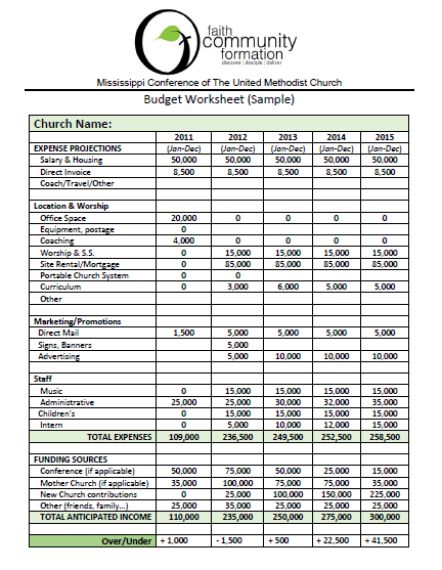

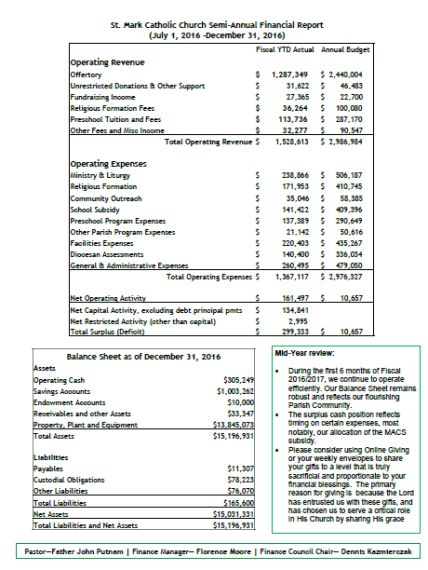

Similar to other institutions, churches too require an effective budgeting plan so to highlight the activities as a cause of their expenditures. It displays the ministry’s action plan for the year while shedding light on the church’s finances.

Contents

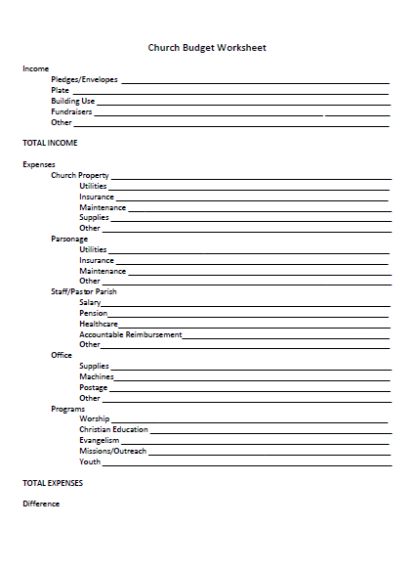

Sample Church Budget

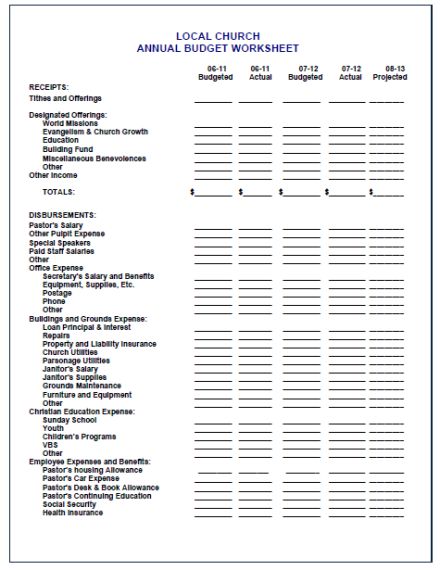

Given below is an example of a sample church budget template which could be used by small churches. It gives the basic idea of the constituents which are present in a typical church budget.

Particulars Amount

Incomes :

Pledges xxxxx

Special Offerings xxxxx

Cash Offerings xxxxx

Sunday School Offerings xxxxx

Gifts xxxxx

Income Received from Interest and Dividend xxxxx

Income Received from Rental Properties xxxxx

Miscellaneous xxxxx

Total Income xxxxx

Expenditures:

Pastor-Related Expenses

Salary xxxxx

Housing Allowances xxxxx

Pension xxxxx

Pastor-Related Subtotal: xxxxx

Administration Expenses

Salaries Paid xxxxx

Supplies xxxxx

Property Maintenance Charges xxxxx

Utility Charges xxxxx

Insurance Premium xxxxx

Telephone Charges xxxxx

Postage Costs xxxxx

Literature xxxxx

Flowers xxxxx

Computer Maintenance Charges xxxxx

Transportation Costs xxxxx

Publicity Costs xxxxx

Administration Expenses Subtotal: xxxxx

Expenses from Ministry Programs

Youth Programs xxxxx

Music Programs xxxxx

Worship Programs xxxxx

Expenses from the Ministry Program’s Subtotal: xxxxx

Mission Programs

Local Mission Programs xxxxx

Foreign Mission Programs xxxxx

Mission Programs Subtotal xxxxx

Funds and Reserves

Debt Retirement Funds xxxxx

Infrastructural Funds xxxxx

Contingency Reserves xxxxx

Funds and Reserves Subtotal xxxxx

Total Expenditures xxxxx

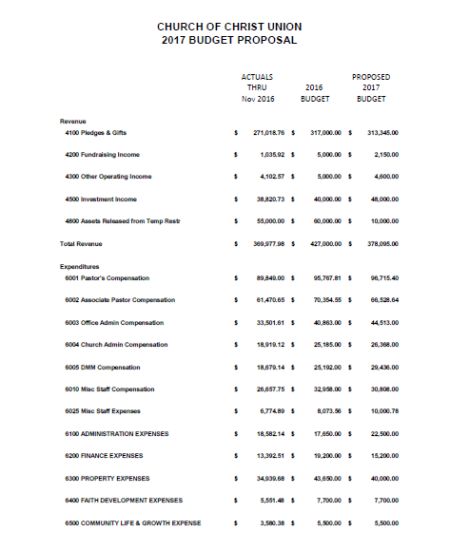

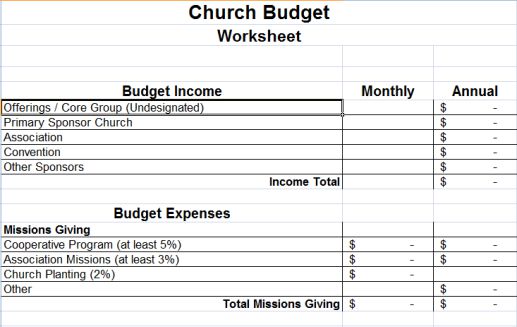

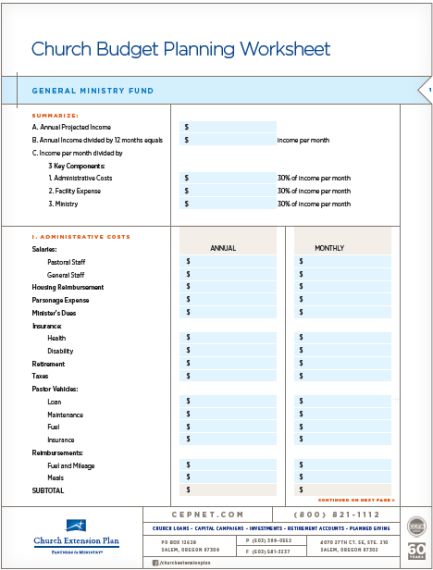

Church Budget Proposal Template

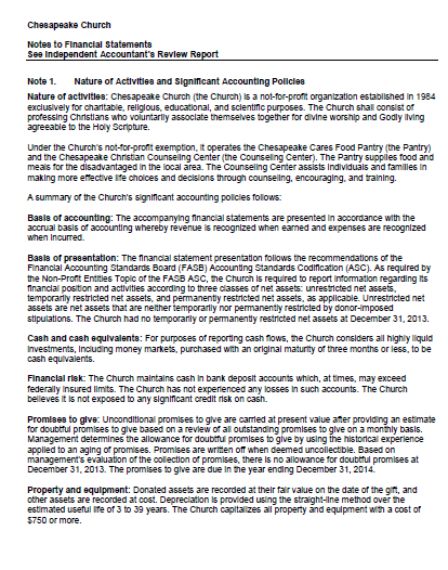

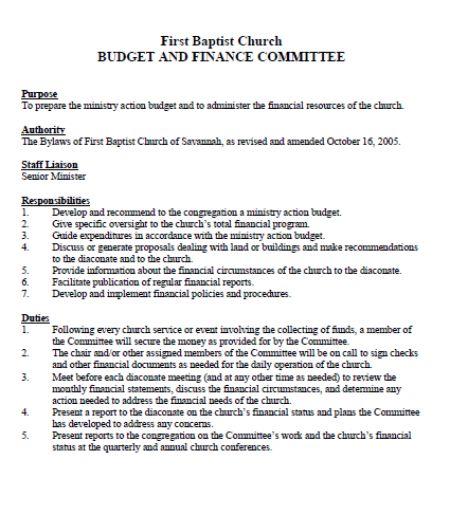

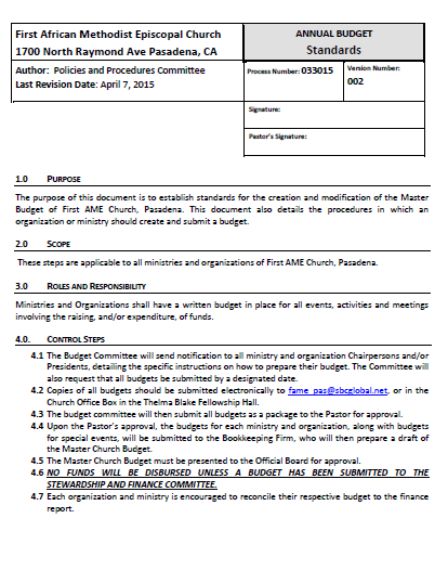

Being somewhat akin to our lives, a church also needs to duly maintain a budget statement so that the cash inflow and outflow from the church can be maintained. In order for a church budget proposal template to be rightly executed and implemented, the budget proposal usually needs support from the maximum number of elders. Such a committee is often created when the church wants to implement a successful budget.

An example of a church budget proposal template is given below:

Church Budget Proposal

Particulars Amount

Summary of Incomes:

- Projected Incomes Over the Year xxxxx

- Projected Incomes Divided by Monthly Equals xxxxx

- Projected Incomes per Month

- Administrative Costs x% of monthly projected income

- Faculty Expenses x% of monthly projected income

III. Ministry Expenses x% of monthly projected income

Particulars Monthly Annual

Summary of Expenditures

- Administrative Costs

- Salaries

Salaries for Pastors xxxxx xxxxx

Salaries for General Staff xxxxx xxxxx

- Housing Reimbursement xxxxx xxxxx

- Expenses for Parsonage xxxxx xxxxx

- Minister’s Dues xxxxx xxxxx

- Insurance Premiums

Health Insurances xxxxx xxxxx

Disability Insurances xxxxx xxxxx

- Retirement Payments xxxxx xxxxx

- Cost of Taxes xxxxx xxxxx

- Pastor’s Vehicular Costs

Loan on Vehicles xxxxx xxxxx

Maintenance Costs xxxxx xxxxx

Fuel Costs xxxxx xxxxx

Insurance Premium Costs xxxxx xxxxx

- Reimbursements Charge

Fuel and Mileage Reimbursements xxxxx xxxxx

Meals xxxxx xxxxx

- Worker Compensations xxxxx xxxxx

Subtotal of Administrative Costs xxxxx xxxxx

- Facility Expenses

- Mortgage Costs xxxxx xxxxx

- Insurance Costs xxxxx xxxxx

- Equipments xxxxx xxxxx

- Depreciation of Machinery xxxxx xxxxx

- Infrastructure Maintenance xxxxx xxxxx

- Property Tax xxxxx xxxxx

Subtotal of Facility Expenses xxxxx xxxxx

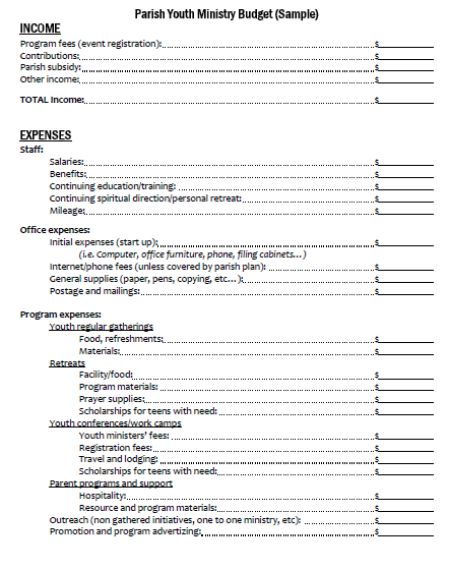

III. Ministry Expenses

- Christian Education xxxxx xxxxx

- Men’s Ministry xxxxx xxxxx

- Women’s Ministry xxxxx xxxxx

- Outreach Programs xxxxx xxxxx

- Benevolence Programs xxxxx xxxxx

- Utilities

Electricity Expenses xxxxx xxxxx

Gas Expenses xxxxx xxxxx

Internet Charges xxxxx xxxxx

Telephone Charges xxxxx xxxxx

- Ministry Vehicle Costs xxxxx xxxxx

- Office Supplies xxxxx xxxxx

Subtotal of Ministry Expenses xxxxx xxxxx

- General Mission Fund

- Annual Budget Amount xxxxx xxxxx

- Projected Missions Income xxxxx xxxxx

Subtotal of General Missions Fund xxxxx xxxxx

Total Expenditures xxxxx xxxxx

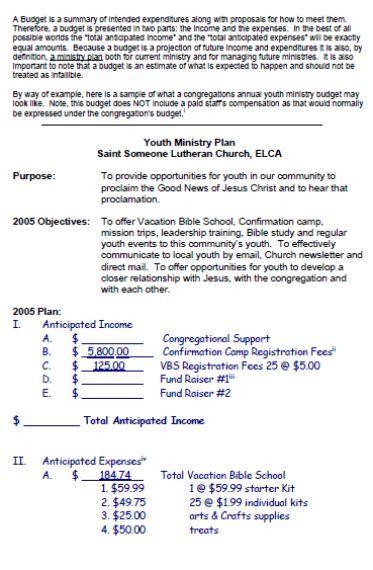

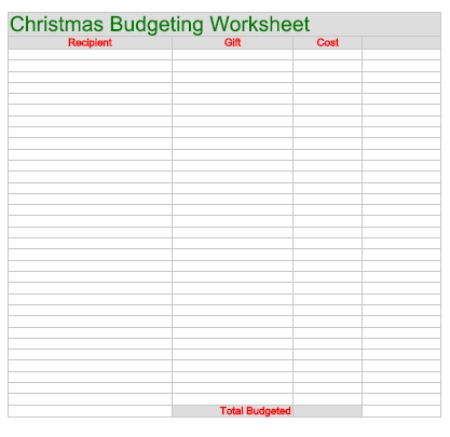

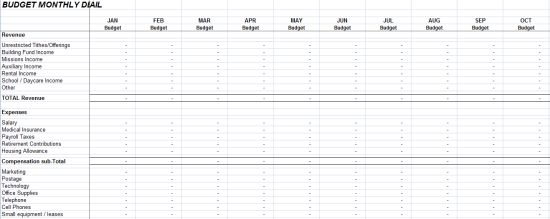

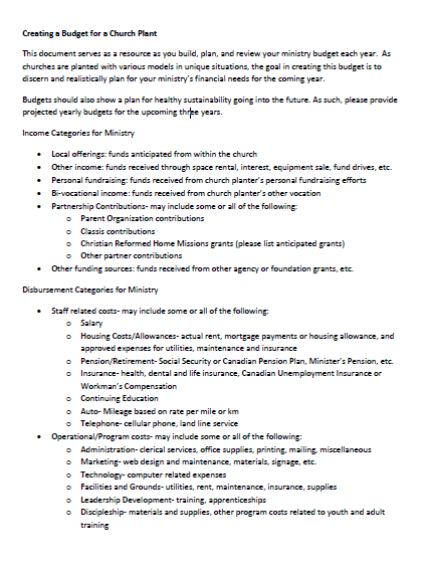

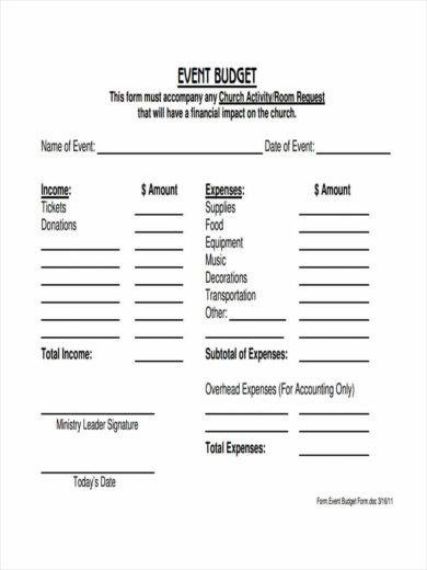

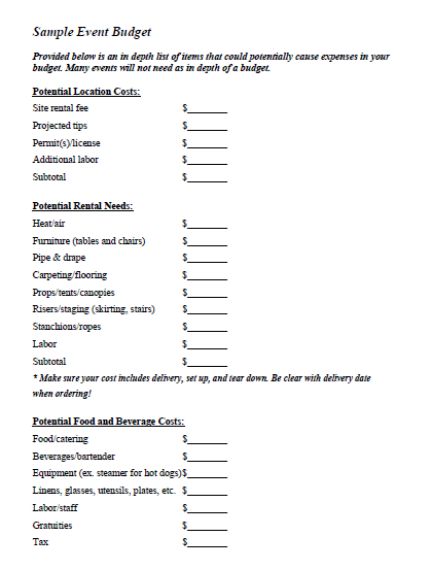

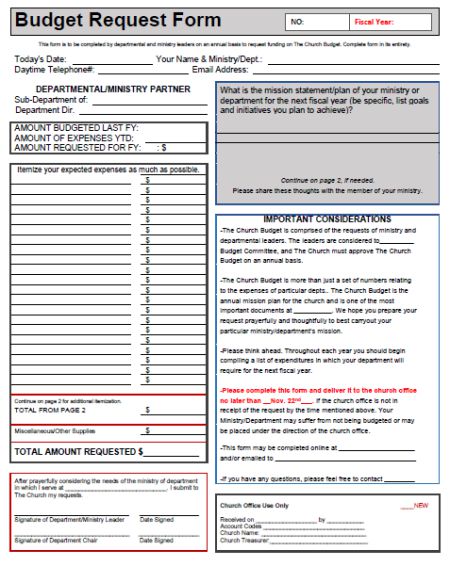

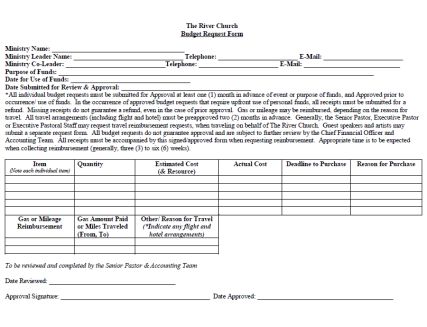

Church Event Budget Template

Creating and managing budgets for special events is another of the responsibilities that the church has to perform. Monitoring event budgets are another of the important aspects of planning and management. Without a centralized system of management, the budget system can easily go haywire. That’s why you need to estimate and create budgets to help you accurate manage the event. To attempt helping you with a template, we have provided one below:

Particulars Previous Yr. Actuals Current Yr. Estimate

Incomes:

Tax Returns xxxxx xxxxx

Planned Giving xxxxx xxxxx

Donations xxxxx xxxxx

Income from Fees xxxxx xxxxx

Income from Trading xxxxx xxxxx

Income from Grants xxxxx xxxxx

Interest Received from Bank xxxxx xxxxx

Fundraising Amounts xxxxx xxxxx

Other Incomes xxxxx xxxxx

Donations for Aid xxxxx xxxxx

Total Incomes xxxxx xxxxx

Expenditures:

Common Funds xxxxx xxxxx

Aids or Grants Provided to Charities xxxxx xxxxx

Charges for Minister xxxxx xxxxx

Costs for Accomplishing the Mission xxxxx xxxxx

Running Costs xxxxx xxxxx

Maintenance Costs xxxxx xxxxx

Trading Costs xxxxx xxxxx

Costs for Organizing The Fundraiser xxxxx xxxxx

Salaries to Organizers xxxxx xxxxx

Administrative Costs xxxxx xxxxx

Total Expenditures xxxxx xxxxx

Surplus/Shortfall of Funds xxxxx xxxxx

Church Budget Percentages

When a church sets form to set estimates for the various expenses expected to occur in the upcoming days, they refrain from following any single standard. The simple reason for this is that there are a plethora of variables which are of a diverse nature. Due to this, there is no single standard.

A few of the variables include:

- Size of the church

- Vision and Mission statement of the Church

- Ministry Philosophy

- Property Values

- Other Facility Values

- Provision of Staff and such.

Importance of a Church Budget

Church budgets are highly important. Not only are these budgets symbolic of the church’s financial health, but they also effectively highlight the path followed by the church in accomplishing their mission. Church leaders who fail to develop an effective budgeting strategy for themselves, constantly create an environment of personal stress and complaints amongst their members.

There is, but, only one reason why churches should never avert from the chance of developing a church.

A few other reasons why churches shouldn’t shy away from developing an effective budgeting plan are:

- They are symbolic of the Church’s mission – There is no one who cognizes the church’s mission better than the leader. He is the only one who passionately performs the required actions and duties for accomplishing the mission.

However, the church budget is depictive of whether the church’s mission has been accomplished or not. These budgets show how the church prioritizes on spending their resources. With the help of a budget plan, the church leader can accurately allot finances to set the church to assail on the right course of action.

- They act as tools to evaluate the church’s performance – With the help of a budgeting process, church leaders can accurately plan to set realistic goals. Such planning results in the right assignment of manpower which in turn leads to the precise accomplishment of goals. When such jobs are assigned with the right manpower, they are also reflective of how a particular employee or group of the church functions.

- They showcase the plan which the church has in mind – A church leader can lead the church only and only when his select set of goals have been accurately defined. With the help of a budget, he can proceed on contemplating their execution. A budget showcases the execution design of these plans.

A lot of churches err gravely when they follow up on the prior execution plans. The problems of today require adequate planned solutions of today too. Keeping this in mind, church leaders should budget plans which are updated to solve the problems of today and ahead with smooth execution.

- They eliminate disputes and improve communication – Budgeting improves the day-to-day functioning of a church by lessening any complications or disputes. Normally, all planning session is performed in the midst of a committee of church elders. Due to this, all the planning and allocation is done with the confirmation of these elders.

The advantage of this is that these sessions help to lessen any disputes that may occur in the foreseeable future. Apart from this, such interactive sessions also allow people to understand the priorities and duties. This helps them to improve communication within the institution.

- They hold people accountable – A church budget needs to execute properly. Not only does this help in the accomplishment of church goals but also helps to keep the expenditures in check. In a church, overspending is not the only expenditure to be interpreted as unhealthy. Underspending is a massive problem as well.

A lot of people presume underspending to be a boon. However, that is not the case. Resource spending is symbolic of the decent execution of goals. Although, with underspending, people can raise concerns on the accomplishment of goals. This, in turn, helps to hold people accountable.

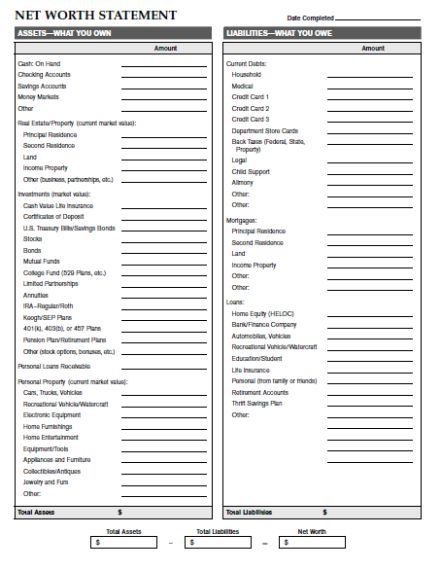

Elements of A Church Budget

Each and every church is unique in their own terms. Therefore, it does not come as a surprise that every church has a distinct style of defining their church budget system. In spite of this, there are a few aspects of budgeting which are common in each and every church budget.

These include a section for:

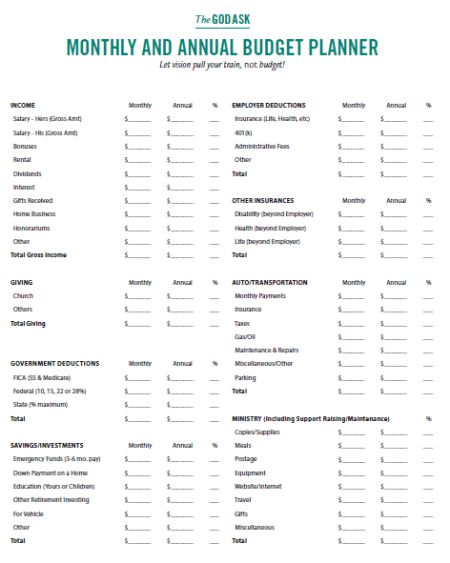

- Projected Incomes – This section includes the Annual Projected Income and the Annual Income divided by 12 monthly equals or Monthly Income.

- Administrative Costs – Administrative Costs refer to the expenses required for the smooth running of human elements within the institution. These include the Salaries of the Pastoral and General Staff, Housing Reimbursement, Minister’s Dues, Insurance, Retirement, Taxes, Reimbursements etc.

- Faculty Expenses – Faculty Expenses are required in maintaining the infrastructure of the church. These expenses include Mortgage, Insurance, Lease, Equipment, Depreciation, Maintenance etc.

- Ministry Expenses – Ministry Expenses are the costs which the Church spends to provide welfare to the society. Examples of these costs are Christian Education, Youth/College/Young Adults, Women’s Ministry, Senior’s Ministry, Advertising, Benevolence etc.

- Subtotals for the sections mentioned – Each and every section mentioned above has a section accompanying them. These sections are termed as Subtotals wherein the totals of each individual section is calculated and stored. This is done for the convenient calculation of the Totals later on.

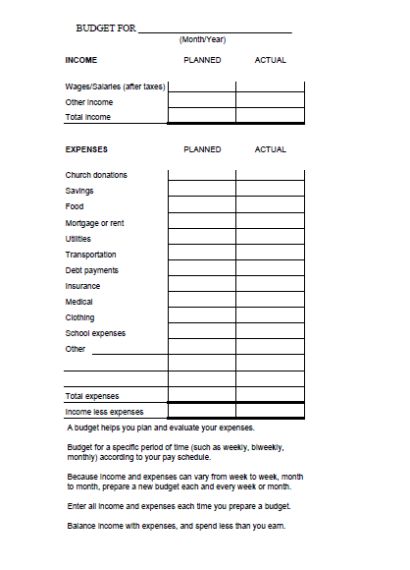

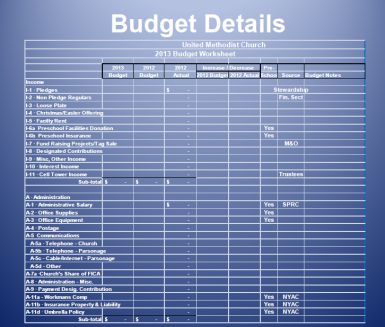

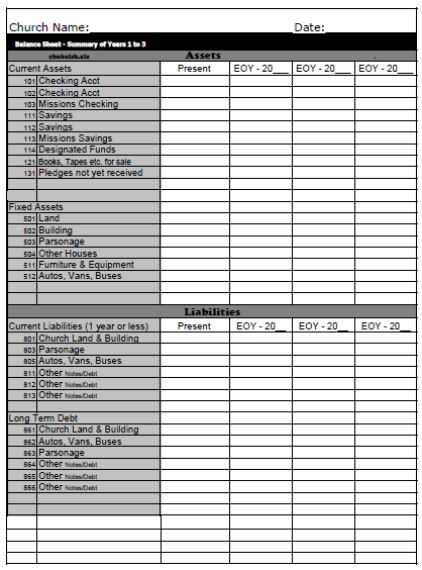

Structure of a Church Budget

A church budget is designed in a way that is similar to other accounting statements. Traditional church budget structures contain:

- A spreadsheet which is created and divided into two sections. The left side of the spreadsheet contains the Particulars and the right side consists of the Amounts or Values.

- Next, go ahead and create the Amount column. A lot of church budgets include their previous year actuals or their next year estimates as well. Few churches include both of them. To do this, you can divide the Value column into two or three sections according to the quantity of data that you want to include.

- The Particulars column is to be further divided into two sections. The Expenditure section and the Income section.

- Now, under the Income section mention the Projected Incomes subheading and then go ahead to fill the details of the Annual Income and Monthly Income.

- Perform similarly to the Expenditures section. Mention the subheadings for the Administrative Costs, Faculty Expenses, and the Ministry Expenses. Go ahead and fill out the expenses under the respective subheadings.

- Make sure to include a subtotal for these values under the end of each section.

- Finally, go ahead and calculate the total for the Expenditures and Incomes section.

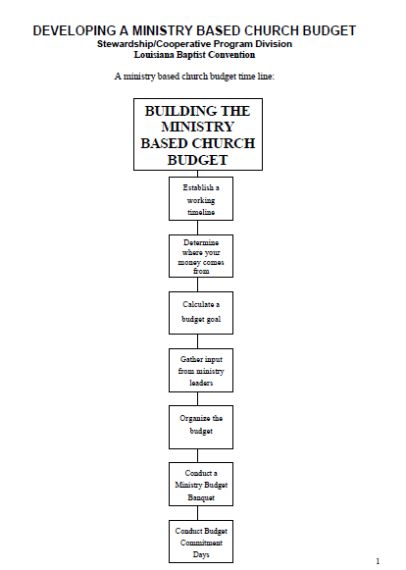

How To Do Budgeting For A Church

Normally, church leaders and pastors feel that their concerns should lie only in matters which deal in making the world a better place. Such concerns include jobs such as leading, educating, counseling etc. And this is 100% correct. However, making sure that all resources are correctly allocated, makes sure that you, as a pastor, are able to perform all the activities which are mentioned above.

Truth be told, creating a budget statement is not an interesting or engaging task at all. It is highly monotonous and repetitive. People drafting a budget statement for the first time even feel the task to be highly intimidating. In spite of this, a budget statement is the lifeblood supporting the mission and goals of the church. Therefore, it is a requisite that you correctly prepare a church budget.

There are various checkpoints in creating a church budget. These include:

- Define Your Income Sources – Start by creating a budget statement that defines all the sources from whence your church earns its funds.

These sources could be of various origins, such as:

- Offerings

- Donations

- Rentals

- Investments etc.

- Examine The Income Sources Carefully – Now that you have a list of all the sources from where your church earns its income, you should examine them to find the sources which can have to be exploited or influenced. Always keep an eye out for opportunities such as areas where your budget can be increased. Get various programs going to help increase the donations. Make notes about the income sources which occur once a year, such as special fundraisers. Prepare for such fundraisers before they approach and perform audits for them.

- Take Advantages of Technological Advancements – With the advancements in technology, there are fewer people who actually carry cash and cheques on their person. Try to take advantage of this. Educate and learn about the working of mobile banking. Make yourself comfortable with this knowledge and proceed to encourage people to contribute to the church with the help of mobile banking.

- Define The Projected Income – Once you’re done defining the income sources, go ahead and set up the projected income. Heavily refer to the revenue statistics of your church in the last few years. If they have been going up for the last few years, make plans to make it go up this year too. Try to increase your earnings by a substantial amount. However, take care to ensure that your approach is one that is led by God and faith. As you go up the ladder, make sure that you find ingenious ways to bring in more funds for the institution.

- Set The Expenses – Move ahead to the expenses section. Start by referring to the expenses from the previous year. Begin filling the expenses into the respective categories prepared. However, you need to make sure that your expenses and projected incomes match. If the numbers don’t match, find means to cut down on the expenses. When the numbers finally match, you will have your budget prepared.

- Go Through The Budget Every Quarter – Ensuring that the numbers on your budget match the ones in real life is probably the hardest part of creating the church budget. In order to make sure that they do, try to go through the budget every quarter. Make amends to the lifestyle of the church if you find that the numbers don’t align. Set up rules to make budget cuts or raise more funds in case the estimated expenses exceed the expenses that occur in real life.

Things To Take Into Consideration While Preparing A Budget

There are a few things that you should definitely consider to make your budget plan as effective as possible. These include:

- The budget plan reflects the missions and goals of the church. Therefore, make sure to highlight the right priorities on the budget statement.

- A prepared budget plan is not constituted only with the help of past incomes or expenditures. It is based on projected or estimated values.

- While working on your budget, you need to include a plan for your expenditures as well. A budget plan works best when you have an included expenditure plan that lists out all the expenses that you should and shouldn’t make.

- The budget plan works only if the entire leadership committee agrees on it. Agreeing on the plan means that it has been perfectly communicated and that it is clear to everyone.

- Once, you have set the wheels in motion, you may expect the plan to work correctly from the very beginning. However, this is never the case. A typical budget plan never works perfectly in the first quarter. Due to this, you need to constantly review your plan and keep it functional and realistic.

Roles and Responsibilities of a Budgeteer

Usually, church budgets are managed either by a single person or by a committee. These budgeteers should be experienced professionals, responsible for creating the church budget and ensuring that the funds owned by the church are alloted evenly. If required, they will also necessitate the adjustment of the budget in cases of a decrease in donations or an increase in the amount of cash flow. Also, such individuals or groups should have the know-how of making choices which, in any way, do not adversely affect the budget of the church.

Apart from this, the budgeteer is responsible for performing audits or preparing forms and data to be presented to auditors. These individuals should record each and every source of revenue and keep proper accounts regarding them. The budgeteer should also hold regular confluences with the elders to discuss the financial health of the institution.

However, in spite of this, there are a few guidelines which all churches follow. Mentioned below are a few typical budget percentages alloted by the churches.

- 10% – 30% of the income is dedicated to Mission Giving purposes

- 20% – 30% of the income is kept aside for the Church Ministry

- 40% – 50% of the income is allocated for paying staff expenses such as pension, healthcare etc.

- 20% – 40% is utilized for Facility Expenses which include costs for building maintenance and such.

A healthy church should always strive to keep staff and facility expenses to the minimum. A majority of the income should be used for the accomplishing the mission of the church.