The concept of being ‘cashless’ has become widespread throughout the world in recent years, especially in the developing countries. Although cash is considered more reliable and is still favoured in many sectors, normal people in these countries have started using online payment services.

Credit cards and debit cards are the most basic and fundamental option which promote the freedom of being cashless. Not only are they more secure, but these cards are also known for their ease of use as they are accepted throughout the world. Nowadays, even small businesses, shops or vendors are accepting payments through this method. Today we are going to discuss one of the major topics regarding customers who want to pay their bills in a cashless way.

Contents

What is an Authorization Form?

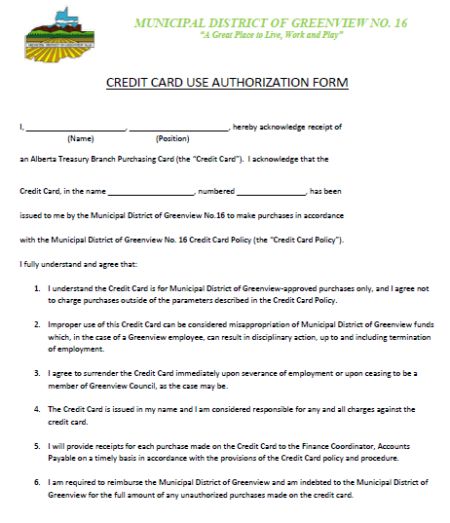

In financial terms, ‘authorization’ can be stated as a process of granting someone access to a document or the ability to conduct an activity. The term ‘Authorization’ can also be limited to a certain transaction or a particular time period or can be indefinite. Therefore, an authorization form is a kind of written confirmation from a particular person through the use of his or her authority, ability, or rank to accept a contract which is legally bound, complete a specific action, pay up the specified sum and perform tasks with his or her powers as well as duties.

Types of Authorizations

The authorization forms signed by the cardholders tend to grant legal consent to other parties so that they can pay or use different services in the name of the cardholders. One must be careful while giving an authorization form to somebody. Almost all types of authorization forms have the following common content: the name of the involved parties, a statement declaring that the permission has been granted, and the signature of the person who has granted consent. Some of the most popular types of Authorization are:

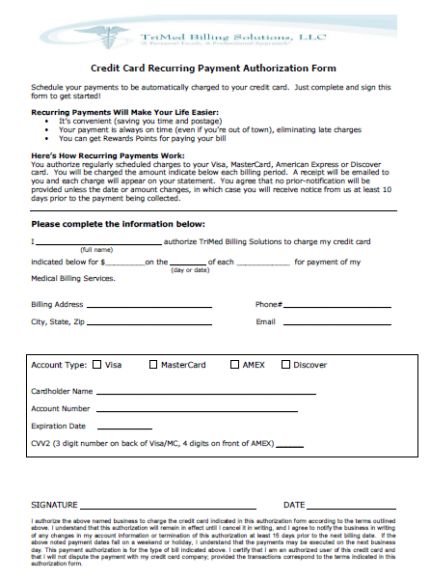

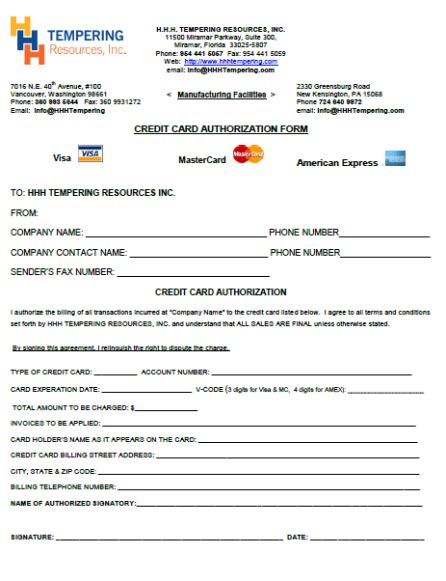

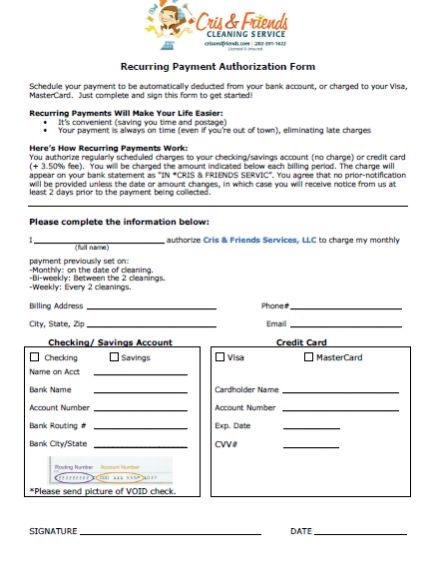

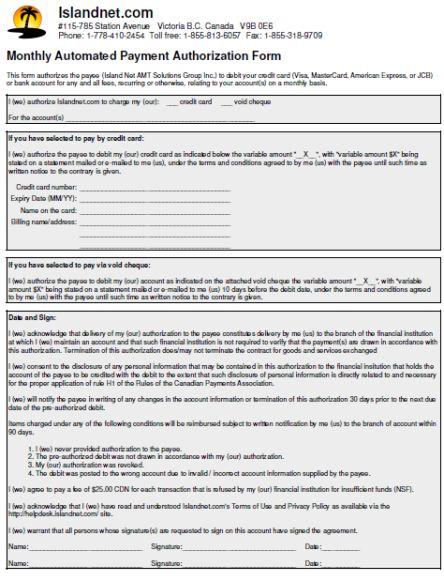

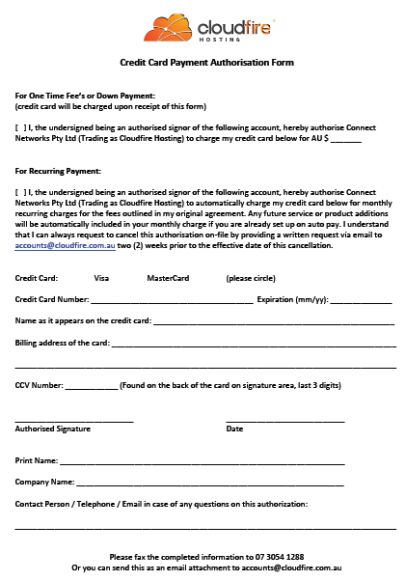

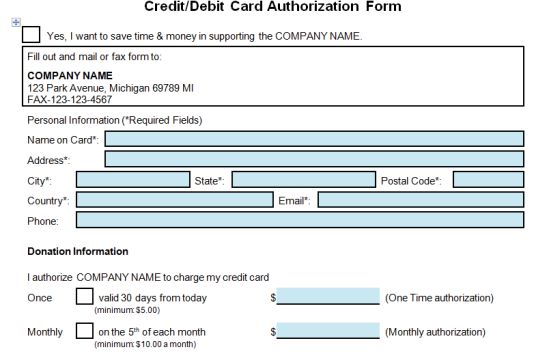

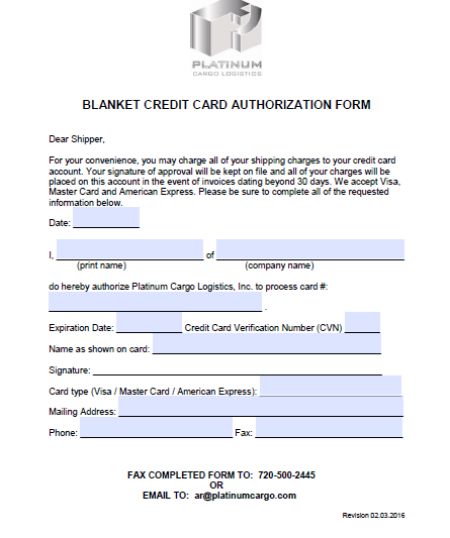

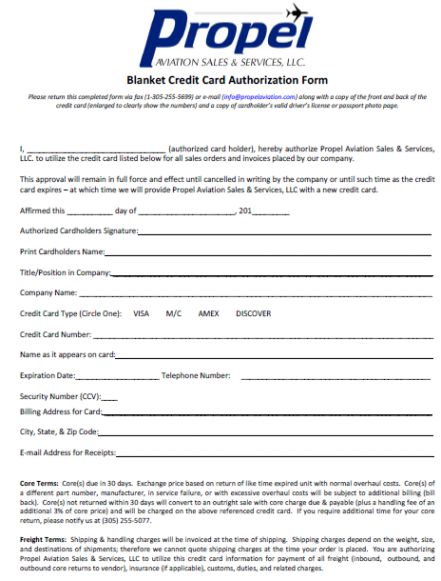

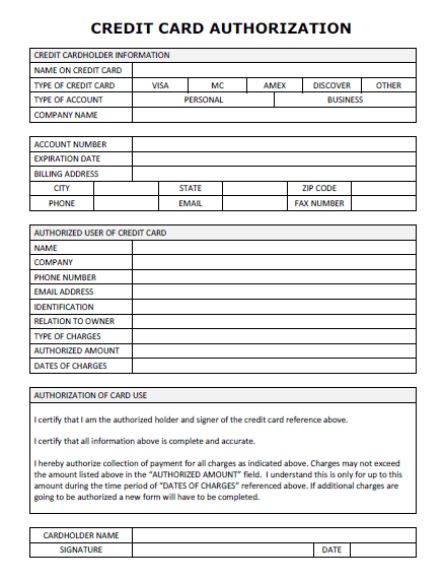

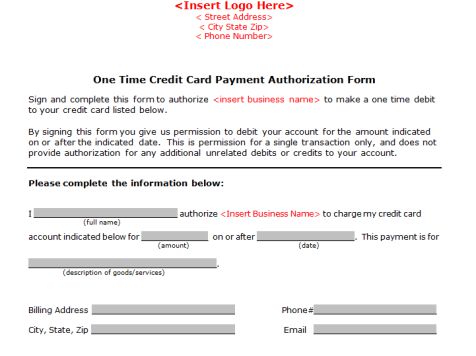

- Authorization related to credit cards– This authorization allows a business or retailer to make a one-time charge or recurring charge on the credit card. The cardholder has to provide the card number, expiration date, security code and other details on the form.

- HIPAA Authorization Form – The HIPAA release form should be read carefully before completely filling and signing it. It is only after that the health care provider has the authority to release an individual’s healthcare information or use it for any other research.

Without the written consent of the patient, even their family members, be it their spouses or children, are not privy to their medical records, diagnosis reports, or any other medical data. It is highly recommended that this form should be signed along with a non-subscribing witness.

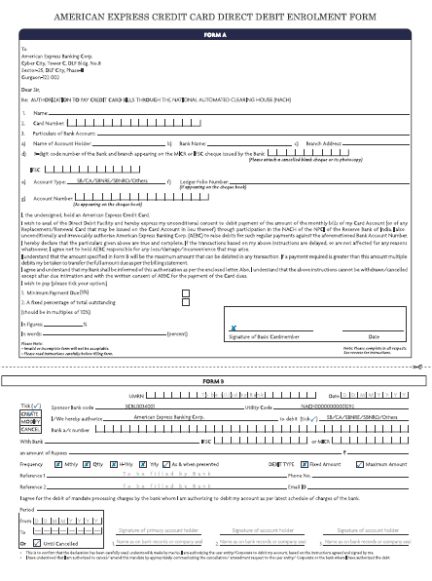

- Direct Deposit Authorization– A direct deposit authorization form is a document which gives authority to a third party. He or she is generally an employer for payroll who sends money to a bank account by using the ABA routing and the account number.

Sometimes the employer will demand a voided check beforehand so as to ensure that the account is valid. After the form has been completed by the account holder, he or she will need to sign it and return it to the employer in which the payroll funds will typically follow suit afterwards.

- Prescription (Prior) Authorization– The doctors’ offices use the prior prescription authorization forms so that they can make a request to an insurer or the government’s office to find out whether a drug is covered by the patient’s health insurance. This form lists the patient’s name, types of symptoms he suffers from, and the reason for the drug’s medication over other available and approved ones.

After the form has been filled up, it can be emailed or faxed to the concerned party. The answer is usually given in between 10 to 14 business days. The medical office where the patient is undergoing treatment is the party who is required for filling in this form, not the patient himself.

Advantages of using Authorization Forms

Using authorization forms during any process eases up the difficulty of the job. Some of the advantages of using these forms are listed below:

- Hardcopy Evidence – Having a backup by making a photocopy of the completed and final authorization form before sending it is advised. If due to any unforeseen event, the form gets misplaced, the person who sent it would have a hard copy as assurance.

- Punctual Timing – As all authorization forms have clear and essential details filled with them, it is not very hard for official or governing bodies to check and verify them. Hence their reply is sent within the estimated time period.

- Official Statement – Any authorization document is filled with the consent of all the related parties. The form is verified and only gets accepted if it is valid under all the laws concerned. Hence these authorization forms have considerable weight

- Useful in Emergencies – In normal circumstances, one can easily do all the work without the need for an authorization form. It is only in case of emergencies that the need and importance of an authorization form shines.

- Efficiency – While registering the payment details of the customers, the merchants can make the use of a single authorization form related to credit card to be filled up by the customers instead of using multiple forms. This will increase the business’s processing capacity and the reduced number of documents may help to simplify the organization and storage of records and data.

- Building up consumer trust – One needs to instil confidence upon the cardholders so that they can realize that their personal information will remain secure. The main step here is to use a well-designed authorization form related to credit card so that it shows one’s professionalism and commitment to conducting proper transaction and documentation.

- Protection against fraud – There are many kinds of security risks related to the payments which are made through credit cards, but the authorization forms are significant for the purpose of addressing a particular chargeback claim in the future. In this step, the cardholder can make an attempt to reverse the charges by reporting and unauthorized transaction. Thus, the customers can be protected from such kinds of transactions which are fraudulent by keeping a proper record of the signed and completed forms.

What is an Authorization Form related to Credit Card?

Normally when the customer uses a credit card to make the payment at the counter, after swiping the card on the machine, the details of the card are shown on the swipe machine’s screen. The details are checked and confirmed by the credit card provider instantly and then the transaction proceeds. Thus, this method is preferred due to its ease of use and efficiency.

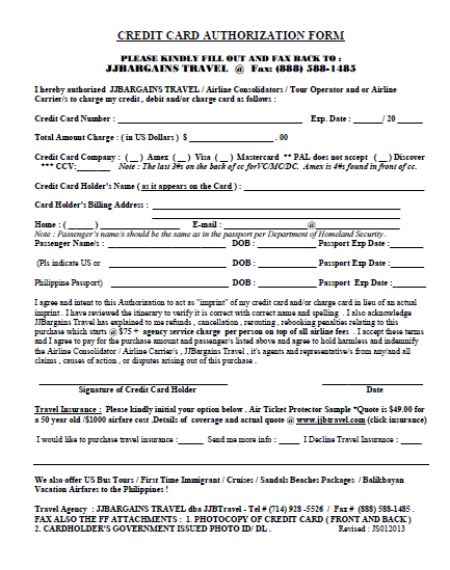

A certain amount of risk is involved while accepting payments through a credit card if the card is not physically present during the transaction. To minimize this risk and stop any chargeback in the future due to disputes, the merchant or retailer asks the customer to sign a credit card authorization form.

Due to any unforeseen event, if someone forgets to bring his or her credit card during the transaction, he or she can opt for the authorization form related to credit card. Thus, the form requires the cardholder to fill in various types of details pertaining to the credit card. After accepting the form, the merchant/retailer sends this authorization form to the concerned company for confirmation of the entered details. This manual method is not much popular among both the customers and shopkeepers who are involved in this process.

This authorization form related to credit card which is signed by the cardholding customer grants the merchant/retailer the permission to charge payments through the credit card. The form gives authority to the businesses to charge the cardholder on a periodic basis – monthly, quarterly or intermittently, until the total amount of the merchandise gets paid.

In what situation can an Authorization Form related to Credit Card be used

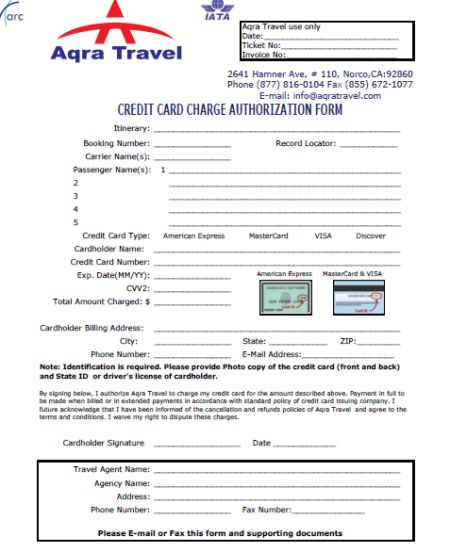

The authorization form related to credit card can be used to resolve a number of scenarios. The most important point to remember is that it is only used if one is not having access to his or her credit card while processing the transaction. Some of the common scenarios are listed below:

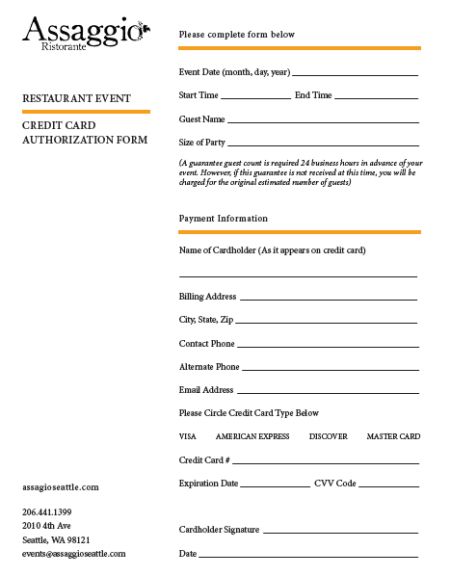

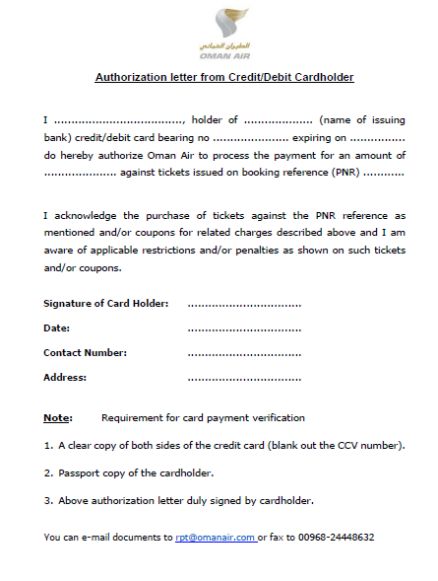

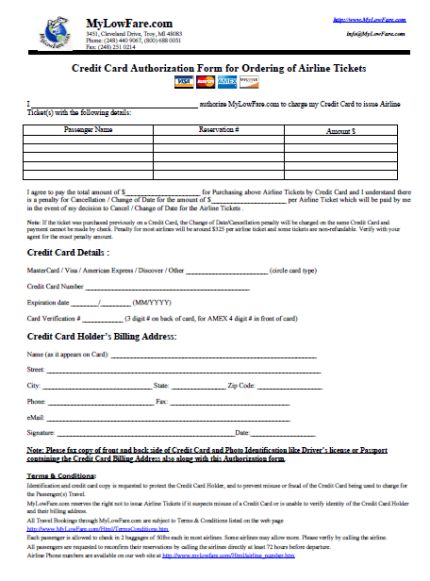

- The absence of the Cardholder – People nowadays prefer to place orders from home via email, phone or an online platform. Hence this form is filled and used during the payment process as the cardholder isn’t physically present during the transaction.

These forms are the key to survival for businesses which are not having any traditional shops. If the business lacks a physical infrastructure while operating, then the authorization forms are extremely essential for them. - Future transactions – This authorization form related to credit card can be used to pay for the bills which are going to occur later on. After performing the transaction, the credit card of the customer is not being immediately charged. Instead, the transaction has a pending status on the account of the cardholder.

These transactions are categorized as ‘authorization only’. Most of the time car rentals and hotel companies charge this amount after the consumer uses their services. After the service, the initial charge may also get adjusted depending upon the quality.

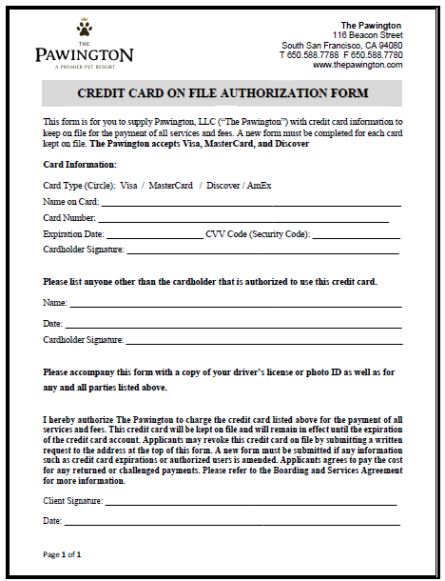

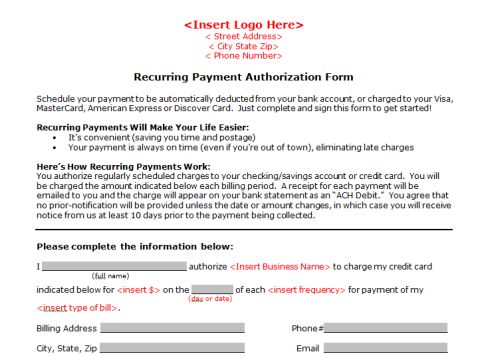

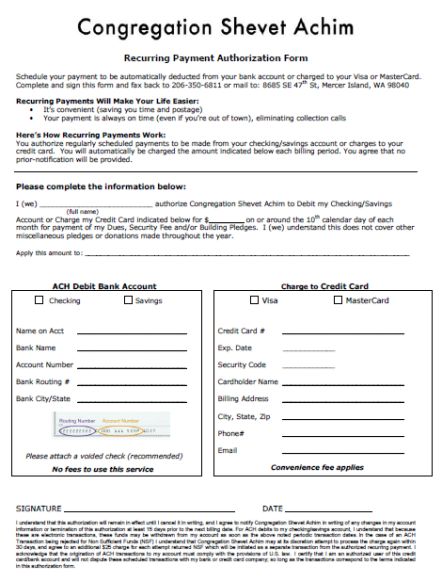

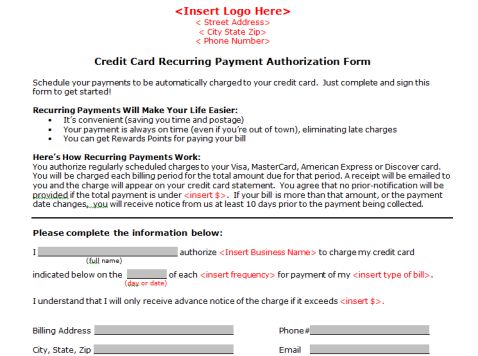

One can make the use of this process when a customer wants to pre-order or put an item on hold. This especially applies when the required item that the customer desires is not present in stock. - For Periodic Charges – One can use the authorization form related to credit card for granting permission to the retailer/shopkeeper to charge for recurring or ongoing payments. This kind of transaction is known as a ‘card on file’ transaction.

The application for this type of transaction is for services based on subscriptions. The subscription provider can charge the customer for the subscription on a monthly basis.

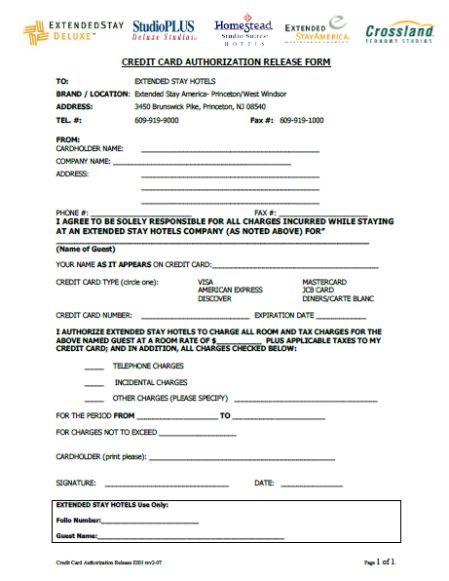

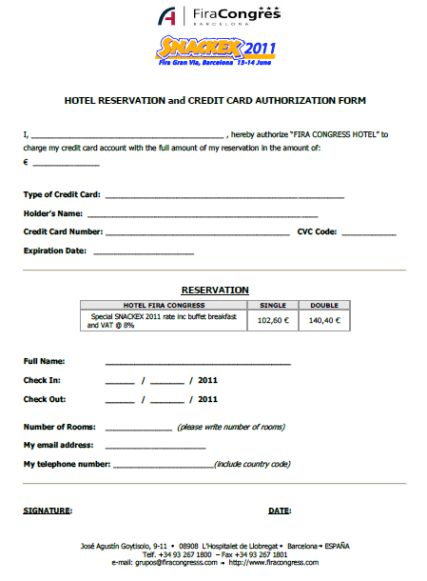

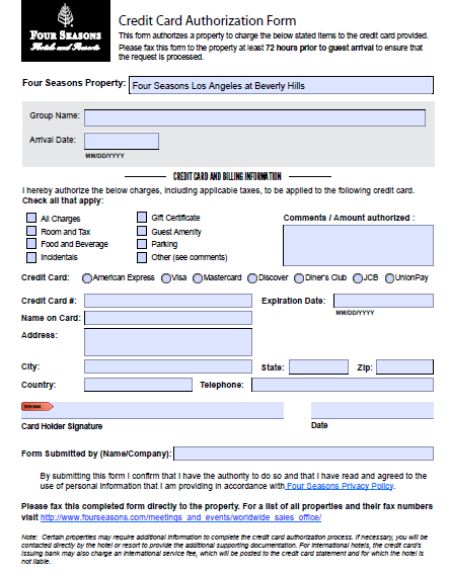

What is meant by the Hotel Authorization Form related to Credit Card

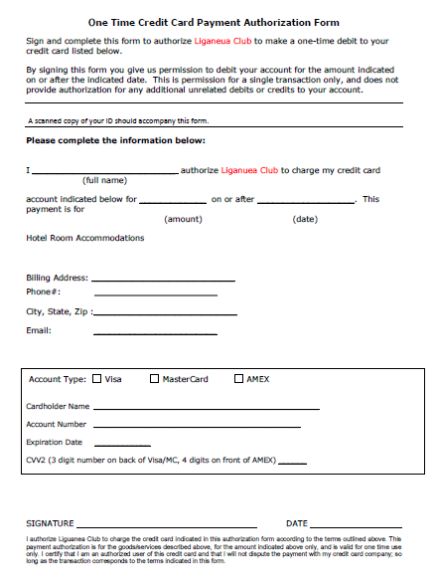

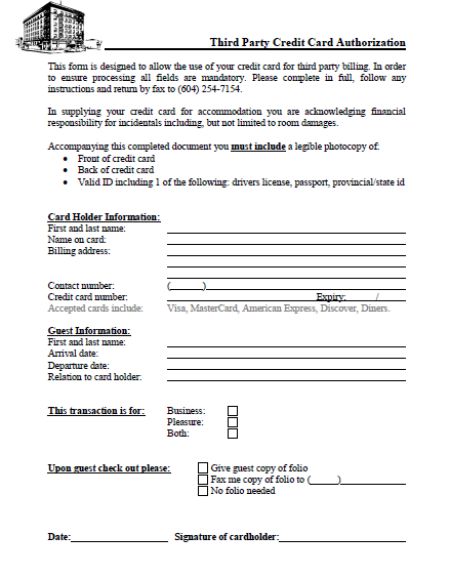

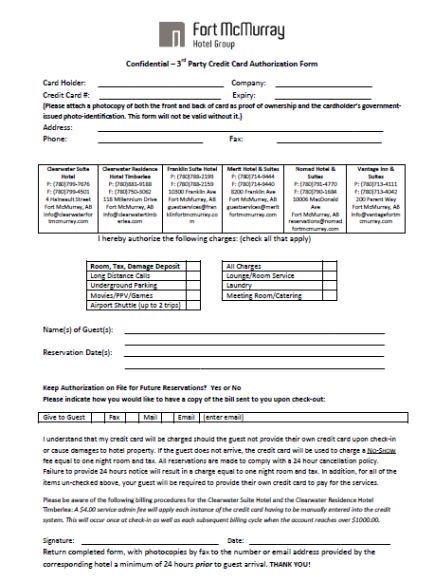

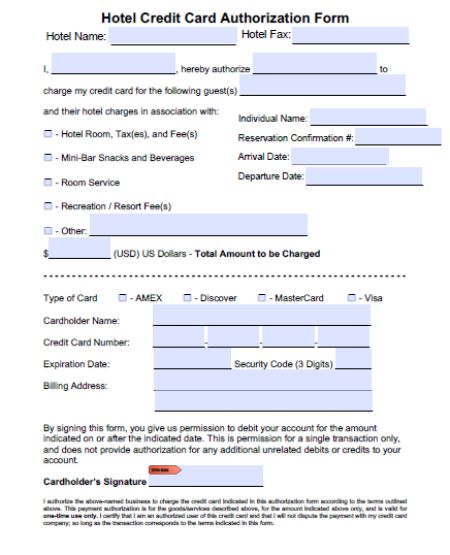

The hotel authorization form related to credit card is for the guests who do not carry a credit card in hand but have this authorization form which is provided by the cardholder. This form must be completely filled along with the cardholder’s signature stating that it may be used for the guest’s stay.

Additionally, the cardholder has the authority to limit as to what the guest can charge on the card such as mini-bar, food, or any extra services that the hotel may offer. If the authorization form limits anything, then a different bill will be prepared for using that service which the guest has to pay individually. The hotel authorization form related to credit card is required to be signed by the cardholder and then should be sent to the concerned hotel either through fax or email before the guest arrives.

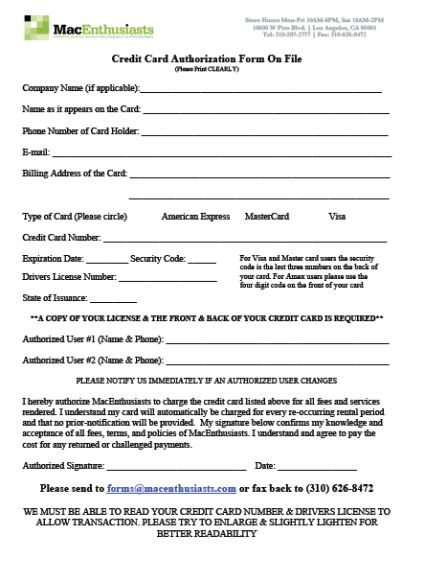

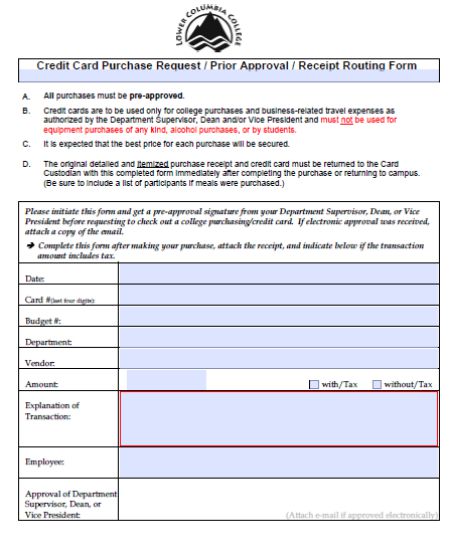

Information/Elements found on a Authorization Form related to Credit Card

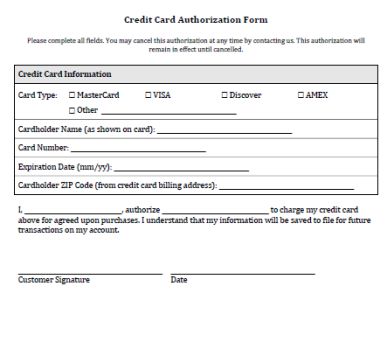

The authorization form related to credit card which is submitted by the cardholder is a legal document. After signing it, the cardholder grants consent to the business to charge his or her debit or credit card. The charges on the card can be paid in a single transaction or on a recurring basis as per the option is chosen.

The signed form will help the business to be safeguarded against any chargeback or financial problems in the future in case of any disputes.

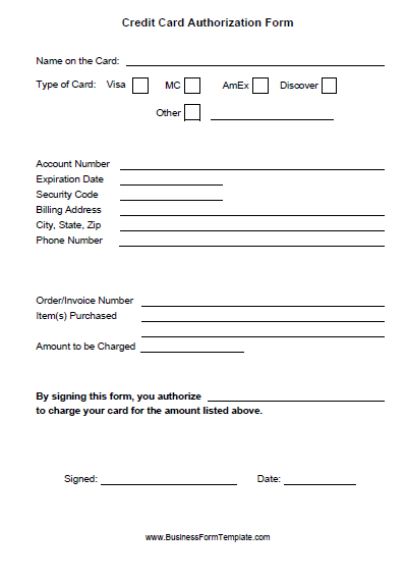

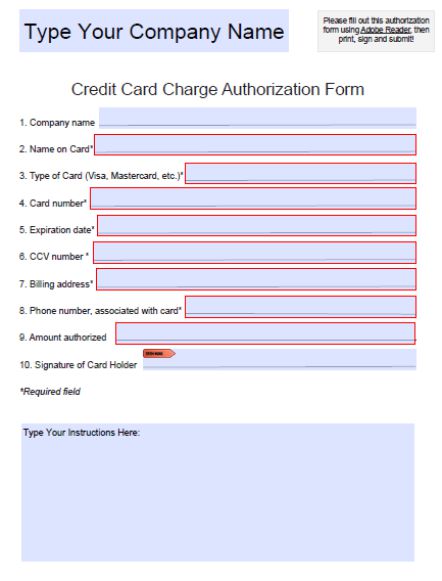

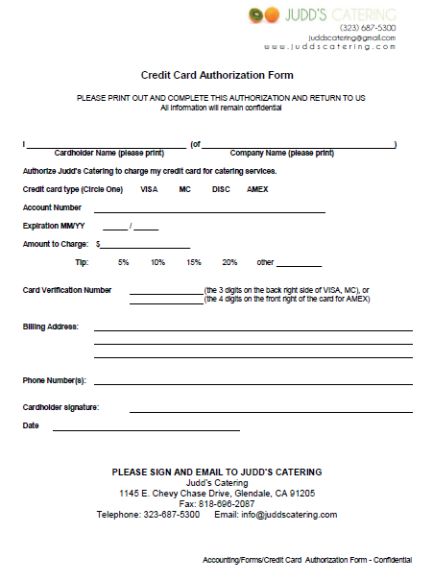

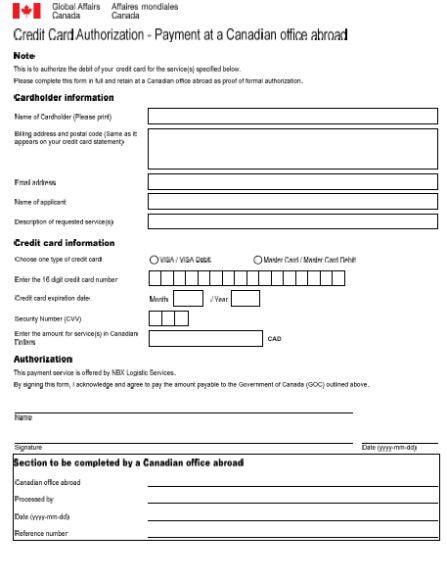

- While creating a template for the form, one doesn’t need to make it too complicated. Below are some basic elements and tips which one can include in his or her template:

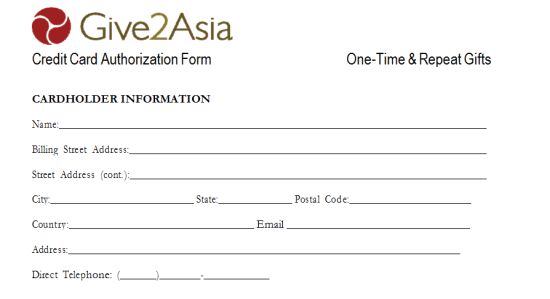

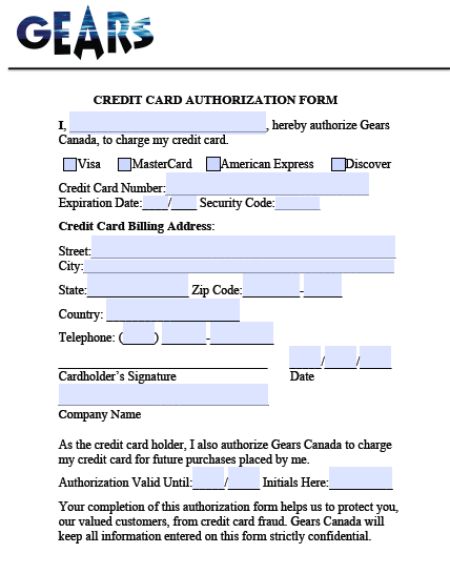

- Details of the cardholder

This part includes the cardholder’s full name, current billing address along with his or her contact information.

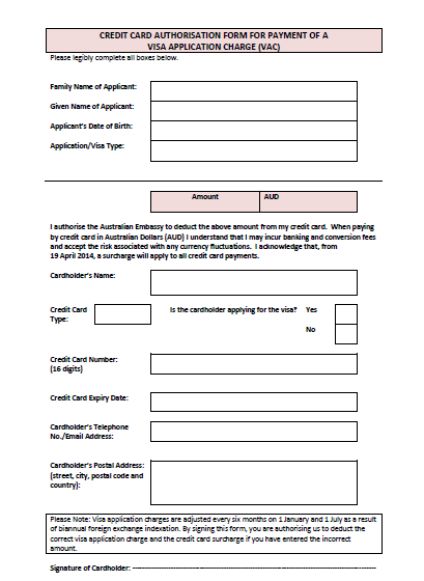

- Details of the credit card

This part includes the details of the type of credit card (MasterCard, Visa, Rupay, American Express etc.) owned by the cardholder. It also includes the credit card number, CVV security code and the expiry date provided at the backside of the card.

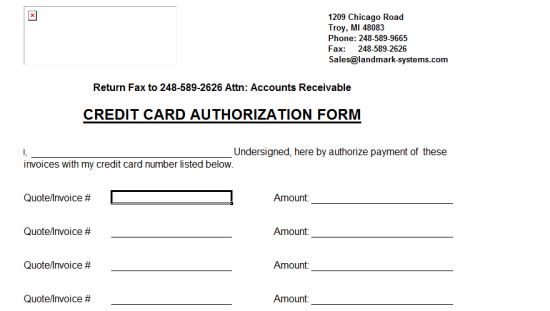

- Business information of the merchant

This part includes the details of the business owner/retailer with whom the cardholder conducted a transaction. The name, address, and contact information of the shop/business is filled here.

- Statement of authorization

This part includes a statement of authorization which applies to the business owner. He/she may also include the type of transaction opted by the cardholder for the payment – a single one or at recurring intervals. One must think carefully and put down a good statement which will give a greater amount of authorization to oneself.

- Signature of the cardholder

For making the authorization document valid, the cardholder must sign and date it. Hence an empty space must be kept for the cardholder to affix his/her signature clearly.

- Recurring charges

There may be situations where a business owner may have current ongoing or recurring charges with a customer. An article was published in the Square related to the processing and best practices related to payment card which said that certain additional information should be included in the authorization form which is being discussed below:

- The previous transaction amounts.

- The frequency of the previously collected charges.

- The duration in which cardholder has been granted permission to clear the total sum.

- Refunds

In the case of payment refunds, the refund should be issued back to the payment card of the cardholder directly. If such cases occur, then an authorization form template related to the refund of credit card can be used. After making the refund through the medium of check, cash or directly into the bank account, one must make sure to have the customers confirm that they have received the refund by signing a written form of statement.

What is the process of Credit Card Authorization?

The approval for the authorization of the credit card is given by the card issuer, usually through the credit card provider. This usually means that sufficient funds are being possessed by the customers for covering the cost of the transaction. The following steps are followed during the complete process of the transaction:

- The Cardholder

A transaction can be done by the cardholder through the medium of credit card by using the particular card in order to pay for the various goods as well as services to the merchant.

- Merchant

The merchant sends the cardholder’s details and the transaction amount to the acquiring bank’s servers by using the credit card machine, gateway or software.

- Acquirer

The transaction details are received by the processing bank who then forwards it to the cardholder’s issuing bank through a particular route for its approval or declination.

- Visa or the MasterCard Network

The information on transaction between the issuing as well as processing banks is being sent by the MasterCard or Visa card through their Banknet or VisaNet networks respectively.

- The Issuer

The transaction details are received by the issuer of the card from the server of the processing bank through the medium of VisaNet or BankNet. After that the response is being given correspondingly either through an approval or a declination of the transaction. The transaction is checked to ensure that the information which has been provided is valid and sufficient balance along with a good standing account is being possessed by the cardholder in order to complete the purchase.

- Visa or the MasterCard Network

A particular code is being sent by the card issuer to the acquiring bank’s server through the medium of a MasterCard or Visa network.

- Merchant

The response code is finally sent back to the, software, gateway or machine of the respective merchant where it awaits for its settlement after being stored in particular files.

How authorization works with relation to credit cards

After the forms are being submitted, request is being sent to the acquirer or credit card processor by the merchant. After that a request is being submitted by the acquirer to the main credit card issuer.

The issuer checks and reviews the customer’s account and verifies whether enough funds are present or not in order to cover the cost of the sale. If customer passes the check, a hold is made on the authorization which in turn reduces the credit line of the customer for the sale amount. The acquirer is being sent an authorization code which is again forwarded to the merchant with an error code or an approval. A transaction becomes incomplete or gets cancelled if there is an occurrence of an error code. Hence, it is always better to know completely about Credit Card Authorization Form and how it works with relation to credit cards to avoid unnecessary issues.

How do businesses/merchants get paid through credit cards

The payment process also has to follow multiple steps before finally getting completed. The steps are mentioned below:

- Merchant

The payment process is begun by a merchant who sends the approved authorizations stored in batches to the server of the acquiring bank usually at the end of every single day.

- The Acquirer

These batches of authorizations are being transmitted by the processing bank through the network of the card association.

The money collected from the sales is being deposited by the processing bank into the account of the merchant. Depending upon the merchant’s processing agreement, the bank debits from the merchant’s account the processing fees daily, monthly or in both ways.

- Card Network

Money is being debuted by the particular association from the account of the issuing bank and is credited to the account of the acquiring bank for the transactions which have been successfully authorized through the medium of fees related to networks, receipts, etc.

- The Issuer

A processing bank gets paid by the card issuing bank for all the purchases made by the cardholder.

- Cardholder

Finally, the cardholder repays the cost of the purchase including accrued interests and fees to the issuing bank.

Standards for Credit Card Collection and Retention

The credit card collection as well as retention laws vary in different states. The Payment Card Industry Data Security Standards (PCI DSS) was created for filling up this legal void and for maintenance of safe and secure practices in organizations that handle information of the cardholder.

Some of the U.S. states follow the PCI DSS guidelines directly despite the non – enforcement of PCI compliance. In 2009, this statement was converted into a state law in Nevada, which required the concerned merchants to comply with the set guidelines.

Depending on the business and the retention policy related to the information of credit card, the statement of authorization must be proper and effective so that it can minimize the fears of the customers regarding any kind of fraud activities.

The requirements for Complying according to PCI DSS

There are many requirements for PCI DSS established compliance rules which are being discussed below:

- One should install as well as maintain a configuration related to firewall so as to protect the data of the cardholders.

- One should never use the vendor provided security parameters and default passwords.

- Proper steps must be taken to protect the stored data of the cardholder.

- There should be an encrypted transferring of the data of the cardholder across the open as well as public networks.

- One should regularly install and update anti viruses so that they can protect all systems against malware.

- The applications and systems must be developed so as to keep them secure.

- The access to the data of the cardholder must be restricted and only the required ones should be known and shared.

- The system components must be identified and authenticated carefully.

- Any sort of physical access should be restricted to the data of the cardholder.

- One should monitor as well as track all the network resource accesses and the data of the cardholder.

- The security systems as well as processes should be checked regularly for any kind of malfunction.

- A strict policy should be maintained regarding the addressing security related to information for the personnel.